Emerging market equities are an asset class which individual investors should include in their portfolios. The relative allocation may vary depending upon individual’s risk profile. Earlier I discussed this asset class and its characteristics from the perspective of dividend investing philosophy. In addition, my investment method also calls for index-based investing to capture general market performance. The discussion below is a relative comparison of index based funds, ETFs, and ETN for India’s market and where they stand with reference to its constituents and performance.

Morgan Stanley India Investment Fund (IIF)

IIF is a closed-end index fund with investment objective of long-term capital appreciation. It seeks to achieve this by investing primarily in equity securities of Indian issuers. The Fund will invest at least 65% of its total assets in equity securities of Indian issuers. As per funds prospectus, equity securities means common and preferred stock bonds, notes and debentures convertible into common or preferred stock, stock purchase warrants and rights, equity interests in trusts and partnerships and American, global and other types of depositary receipts. In addition, the fund can also invest up to 25% of its total assets in unlisted equity securities of Indian issuers.

My observation: The fund is keeping itself open to invest in any possible investment vehicles available in equity markets and then adds non-listed security as a possible option!

India Fund (IFN)

India Fund is a closed-end equity fund. It seeks long-term capital appreciation through investing in the equity securities of Indian companies. It will invest in stocks of small-cap, mid-cap and large-cap companies. It employs a quantitative and fundamental analysis with a bottom-up stock picking and asset allocation approach to create its portfolio. It benchmarks the performance of its portfolio against the IFC Investable India Index.

My observation: It has a simple description, but a confused execution method of combining quantitative and fundamental analysis for bottom picking.

iPath MSCI India Index ETN (INP)

INP is an Exchange Traded Note based on MSCI India Total Return Index. The Index itself is a free-float adjusted market capitalization index designed to measure the market performance (including price and income from dividend payments).

My observation: It is an ETN, a promissory note, and hence investors do not have any ownership of security in fund itself. It attempts to keep it simple and links to MSCI ITR index.

Wisdom Tree India Earnings Fund (EPI)

EPI is an Exchange Traded Fund which tracks the price and yield performance (before fees) of the WisdomTree India Earnings Index. This Index measures the performance of profitable companies incorporated and traded in India that are eligible to be purchased by foreign investors. Index consists of securities that have market capitalization between USD2 to USD10 billion.

My observation: Attempt to tracks the performance of profitable companies. It includes corporations that have large market cap and are eligible for foreign investors.

PowerShares India Portfolio (PIN)

PIN seeks investment results that correspond (before fees and expenses) generally to the price and yield of the Indus India Index. The investment strategy of the fund is to invest substantially all of its assets in a wholly owned subsidiary in Mauritius. The fund may invest at least 90% of its total assets in securities that comprise the India Index and American Depository Receipts based on the securities in the India Index.

My observations: Fund invests through its wholly owned subsidiaries in Mauritius for favorable taxation. It invests 90% in ADRs and India Index companies.

Constituent Analysis of All Funds:

- All these four funds have somewhat similar objective to track performance of Indian Corporations. Funds IIF, IFN, and PIN provide a convoluted description of their investment vehicles and execution methods. Funds INP and EPI have somewhat simple description and simple execution method.

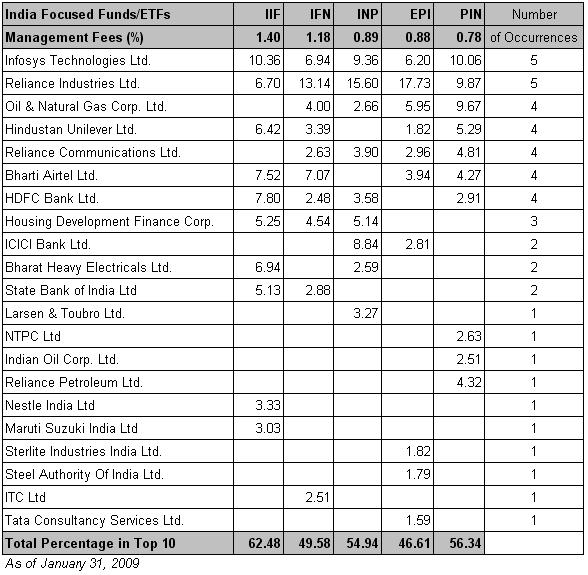

- The attached table shows each fund’s total fees and expenses. Funds with more than 1% fees and expenses are IIF (1.40%) and IFN (1.18%). While funds INP (0.89%), EPI (0.88%), and PIN (0.78%) have less than 1% fees and expenses.

- The total percentage investments in top 10 corporations show that 3 out of 5 funds (IIF, INP, PIN) have more than 50% investments in top 10, while one more (IFN) is close of 50%. Ironically, the fund with highest expenses (IIF) has approx. 62% invested in top 10. Fund EPI has 46% invested in top 10, with almost 17% allocation to just one corporation.

- The table also shows the top 10 individual corporations in which these funds have investments. After such a high fees and varied executions methods, these funds could find only seven specific corporations (in 4 funds or more), four corporations (in 2 or more), only 10 corporations (in one fund only). To put this into perspective, on India’s Bombay Stock Exchange, there were 7500 listed equities (in 2006), 7706 equities (in 2007), 7821 equities (in 2008), and 7784 equities (in 2009). The exchange’s index, known as Sensex, itself has 30 companies on its roll. In short, with all the expertise these funds have, they could only find 21 companies of which more than 10 are common occurrences.

Relative Performance Comparison

The comparison of the relative price movement from January 2007 to January 2009 for all five funds is shown in chart below.

- Ironically, the two funds with highest fees and expenses (IIF and IFN) have the worst performance. These funds have been continuously lagging the market index (^BSESN) for last two years. IIF and IFN have a 10 year historical results which, in general, also shows similar trends. The 10 year past history shows the funds performance is higher than market index during increasing trend, however, during downturns it is significantly lower than market index.

- PIN and EPI are still new and have comparatively shorter history.

- EPI and INP are two funds which, in general, are lagging market index, but relatively better than IIF/IFN funds.

- It is important to note that these are fund performances before fees and expenses. It is likely to be little worse after incorporating fees and expenses.

Conclusion

- IIF and IFN are not worth their fees and expenses, 50% of their assets are invested in almost the same corporations, and have significant lagging performance.

- PIN is very new with complex execution. INP is a promissory note i.e. added risk, and nothing unique with reference to constituents, expenses, and performance.

- Wisdom Tree’s India Earnings Fund (EPI) is relatively a good investment vehicle for individual investors looking for getting general market exposure India’s economy. This fund has a very simple objective of investing in large profitable companies and the ones in which foreigners are allowed to invest. Investors should invest knowing that it has large allocation to one particular company and has 0.88% expenses. As of February 20 2009, EPI is trading at USD10.02. Investors can get exposure to profitable corporations in Indian economy at an attractive value.

Full Disclosure: Long on EPI.